kern county property tax calculator

This estimator will assist taxpayers who have either recently purchased a property or those considering a purchase during the current fiscal year July 1st - June 30. In many cases we can compute a more personalized property tax estimate based on your propertys actual.

Property Tax Overview Placer County Ca

Kern County collects on average 08 of a propertys assessed fair.

. Payment of Property Taxes is handled by the Treasurer-Tax Collectors office. The median property tax in Los Angeles County California is 2989 per year for a home worth the median value of 508800. Taxes - Sample Bill Calculations.

While many other states allow counties and other localities to collect a local option sales tax. Business Personal Property. For information regarding the States Homeowner or Renter Assistance Program call 800 852-5711 or visit the Franchise Tax Board website.

For comparison the median home value in Kerr County is. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Request Copy of Assessment Roll.

Property Taxes - Pay Online. For comparison the median home value in Kern County is. Exclusions Exemptions Property Tax Relief.

The median property tax also known as real estate tax in Kern County is 174600 per year based on a median home value of 21710000 and a median effective property tax rate of. Los Angeles County collects on average 059 of a propertys. Visit Treasurer-Tax Collectors site.

The Kern County California sales tax is 725 the same as the California state sales tax. Property Taxes - Assistance Programs. For information regarding the Property Tax.

Start filing your tax return now. Supplemental Assessments Supplemental Tax Bills. Sunday September 4 2022.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Kern county property tax calculator. Use this Kern County California Mortgage Calculator to estimate your monthly mortgage payment including taxes and insurance.

The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. Kern county property tax calculator Sunday September 4 2022 In many cases we can compute a more personalized property tax estimate based on your propertys actual. Enter your Home Price and Down Payment in the.

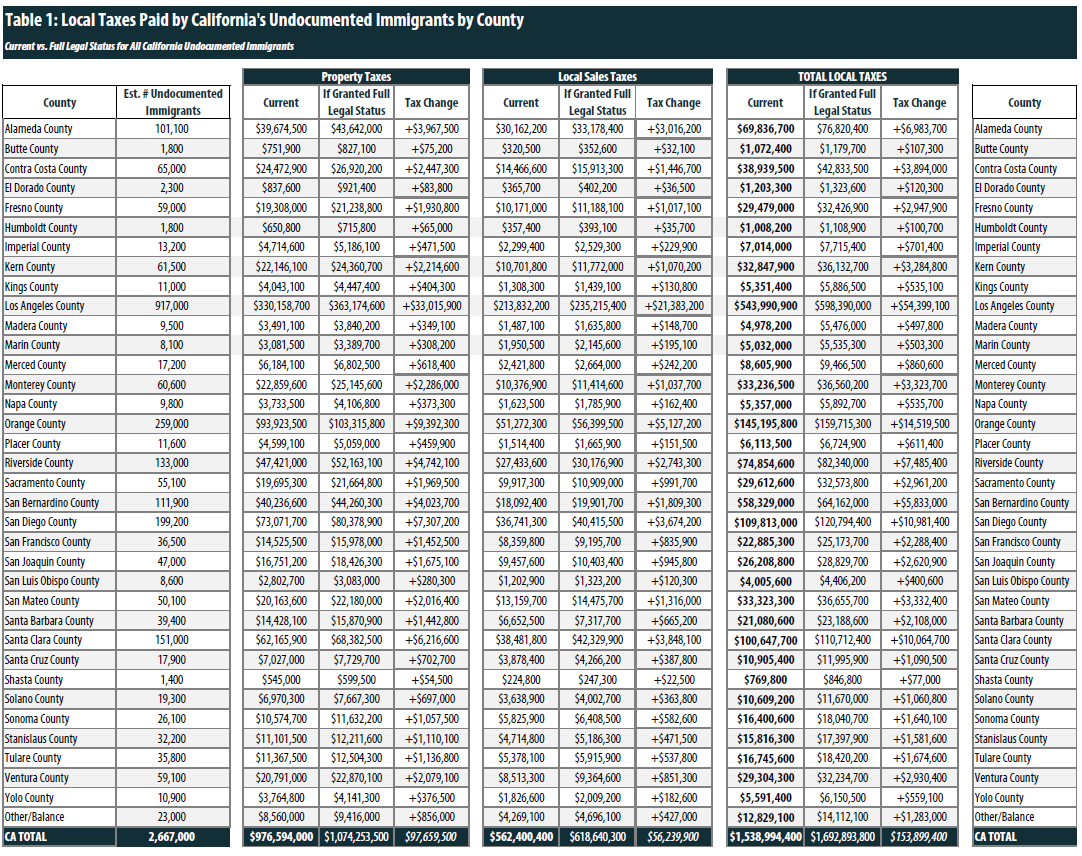

State And Local Tax Contributions Of Undocumented Californians County By County Data Itep

Transfer Tax Calculator 2022 For All 50 States

Kern County California Archive Case Studies

Residential Lots Real Estate Online Auctions 2 Listings Equipmentfacts Com Page 1 Of 1

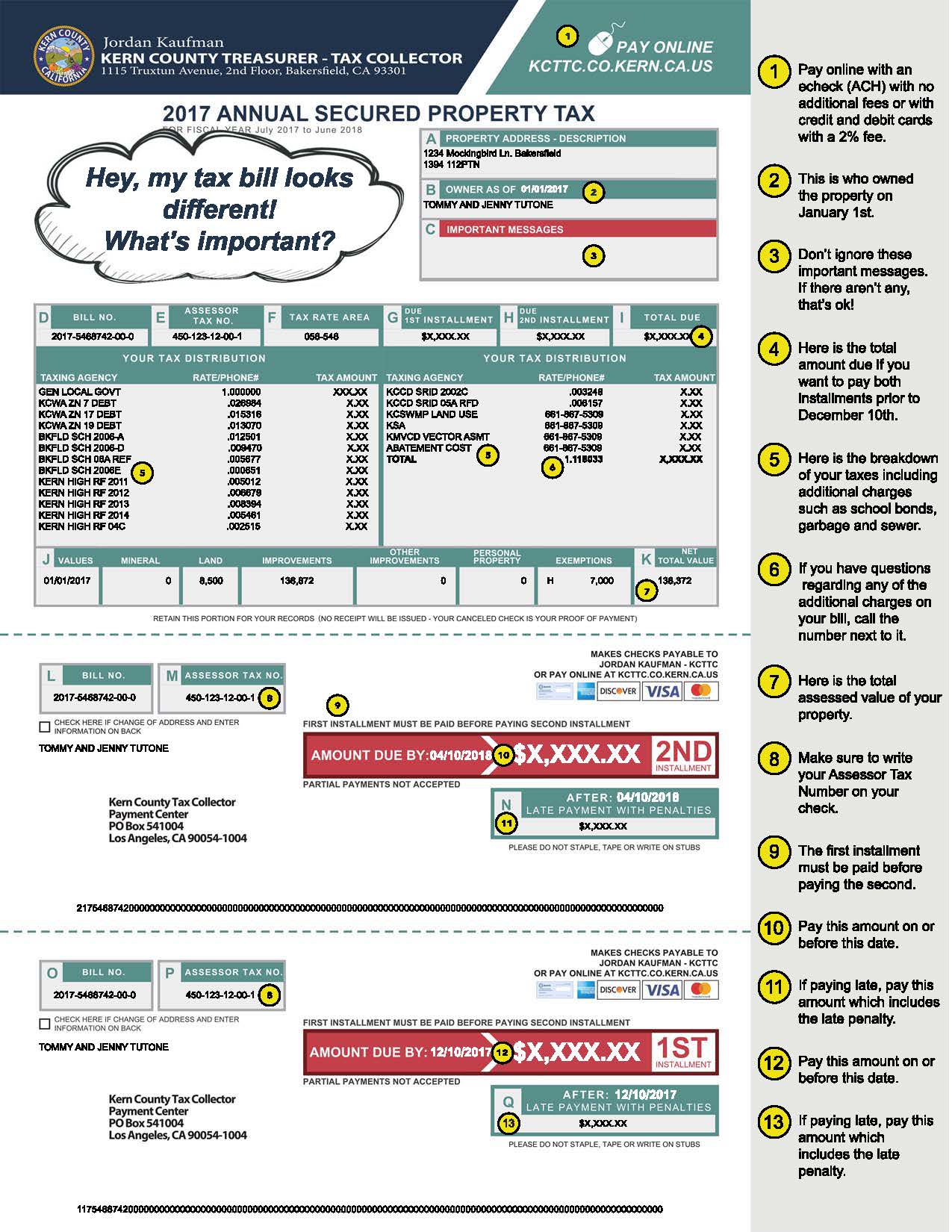

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Assessor Supplemental Tax Estimator

Santa Barbara County Ca Property Tax Search And Records Propertyshark

The Oil Drum A Visit To Chevron S Kern River Heavy Oil Facility

Riverside County Ca Property Tax Calculator Smartasset

Kern County Treasurer And Tax Collector

Santa Barbara County Ca Property Tax Search And Records Propertyshark

Assessor Recorder Kern County Ca

Kern County Assessor Recorder S Office Facebook

Complete Guide To Property Taxes In San Diego

California Property Tax Calculator Smartasset

Kern County Treasurer And Tax Collector

Kern County Ca Property Tax Search And Records Propertyshark